Closing Capital One: “A lost customer is difficult to replace.”

Is my Capital One account closed? It has been so long since I have closed a credit card account that times have changed. My memory of this is mixed with emotional pain so its very fuzzy but I am almost certain that there was a time in credit card history when an account was closed it was closed almost instantly. The account closed so fast that any charges bounced when you tried to make any new purchases.

Is my Capital One account closed? It has been so long since I have closed a credit card account that times have changed. My memory of this is mixed with emotional pain so its very fuzzy but I am almost certain that there was a time in credit card history when an account was closed it was closed almost instantly. The account closed so fast that any charges bounced when you tried to make any new purchases.

Well, this is how it works according to several telephone representatives at Capital One. Your account closes 30 days after you request to close the account unless charges appear on the account. When charges ‘appear’ the policy gets confusing to me. What’s clear to me is that it took over 60 days to close my Capital One account—and I am still not completely certain that it is closed until I see it on a credit report. This was because Dell took too long to ship Windows Vista disks for which we paid 10 bucks with our credit cards. Dell took too long to ship the disks because Microsoft took too long to get Vista on the market. But I’m not going to blame Microsoft for Capital One’s policy. The scenario should have gone like this: Dell never sends me Windows Vista because my credit card account is closed. I am certain that I requested my account be closed before Dell charged me and shipped. But that 30-day window left me open for charges to ‘appear.’

Capital One is not evil. Capital One is very American. You see they did me “a favor” about fifteen years ago when I was subsistence living in Inglewood, California (behind my grandmother’s garage). They used the database smarts of their IT department—led by folks like Gregor Bailar—to make me a sincerely grateful “sub-prime” customer with a secured credit card. Over a decade, that $500 secured card turned into a $6000 unsecured thing—and, when I tried to close the account recently, I felt like I was buying my freedom and leaving the plantation. Like any plantation owner Capital One seemed hurt. Remember that Capital One has a lot of Louisiana heritage. They showed me “kindness” when I was young and sub-prime—and this is how I treat them? My relationship with Capital One characterizes most of the professional relationships I have had in my life so far. The recurring pattern with me is that I get penalized for improving. My improvement is seen more of a threat than a manifestation to welcome and celebrate.

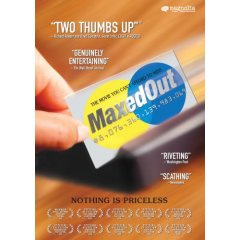

Every American laborer north and south should know that the “tradition” here is that when you do well few need to talk to you—when you screw up that’s when too many people want to talk to you. My credit worthiness means little to Capital One’s profits. Listen to the economics professors in Maxed Out just in case you have trouble with my comments.

Exd 22:25 If thou lend money to [any of] my people [that is] poor by thee, thou shalt not be to him as an usurer, neither shalt thou lay upon him usury.